My dear Twitter Tesla family,

These first five words were not chosen randomly. We all know each other thanks to Twitter. Do you believe anyone reads this SubStack without knowing TBM and her big mouth on Twitter? So we are now in this mess together. The stock is lower than it deserves and the chaos at Twitter keeps on giving, some amusing, some less.

Let me explain my take on this messy day, and please do remember, I may be completely wrong. Just trying to put the bread crumbs together and remembering Elon’s tweets and interviews. This method often fails, as wishful thinking messes everything up.

You all remember Jared Isaacman? Yes, the Jared Isaacman who led the first all- civilian space trip by SpaceX last year, Inspiration 4. Jared Isaacman is the founder and CEO of the payment processing firm Shift4 Payments ($FOUR). He started the firm in 1999, at age 16, in his parents' basement in Far Hills, New Jersey and took it public in June 2020. Today he owns 38% of the stock.

Shift4 handles mainly payments for a third of America's restaurants and hotels. But not only. When I pay my monthly Starlink subscription, it’s processed by Shift4 Payments.

Shift4 announced today a new online payments platform, with enhanced eCommerce capabilities. The press release reads “… easily create a customizable checkout form that can be embedded on any page of a website using just a few lines of code. This form features an intuitive and mobile-friendly UI supporting 24 languages, 160+ currencies and all major card types. It also supports a wide range of payment scenarios, including one-time payments, recurring payments and subscriptions, hybrid billing models with both one-time fees and subscription costs, and variable billing for pay-per-use or pay-per-user business models. The platform also includes smart anti-fraud tools to prevent fraudulent transactions and protect businesses from chargebacks.”

Shift4’s market cap is today just shy of $4bn, in three different share classes.

Why do I talk all this time about Shift4? Because it could just be the missing puzzle piece in my search for an answer to the question why Elon has been selling these past days at least $4bn of Tesla shares. Sold at a ridiculously low price. Of course he can do with his money what he wants, and as a shareholder I know that whilst this may create short term pressure on $TSLA, this usually does not last. But I want to understand whether there is more to come or whether this has a specific purpose.

The most plausible answers to my question are that Elon is reimbursing a short term bridge loan that he obtained at the moment of closing, or that he is trying to purchase the bank loans (total of $13bn at closing) at a heavy discount, which would be very smart. Lots of bankers certainly feeling the heat these days.

And today’s communication, which was clearly initiated from the Chief Twit signal that the company’s financial situation is very dire, and that he needed to sell Tesla stock “to save Twitter”.

Without having all pieces in hand, I still don’t believe the “need $4bn to keep the lights on at Twitter” theory. And it may just be that “save Twitter” does not mean “have $4bn on the checking account to pay the bills”, but “save Twitter by expanding the business, which costs a lot of money”. Who in the world, especially someone extremely intelligent and somewhat frugal, would sell shares at the worst possible moment to have a pile of it on a checking account to keep the lights on?

Some key dates first: The acquisition of Twitter by Elon Musk began on April 14, 2022, and concluded on October 27, 2022. Elon began buying shares of Twitter in January 2022, eventually becoming the company's largest shareholder in April with a 9.1 percent ownership stake.

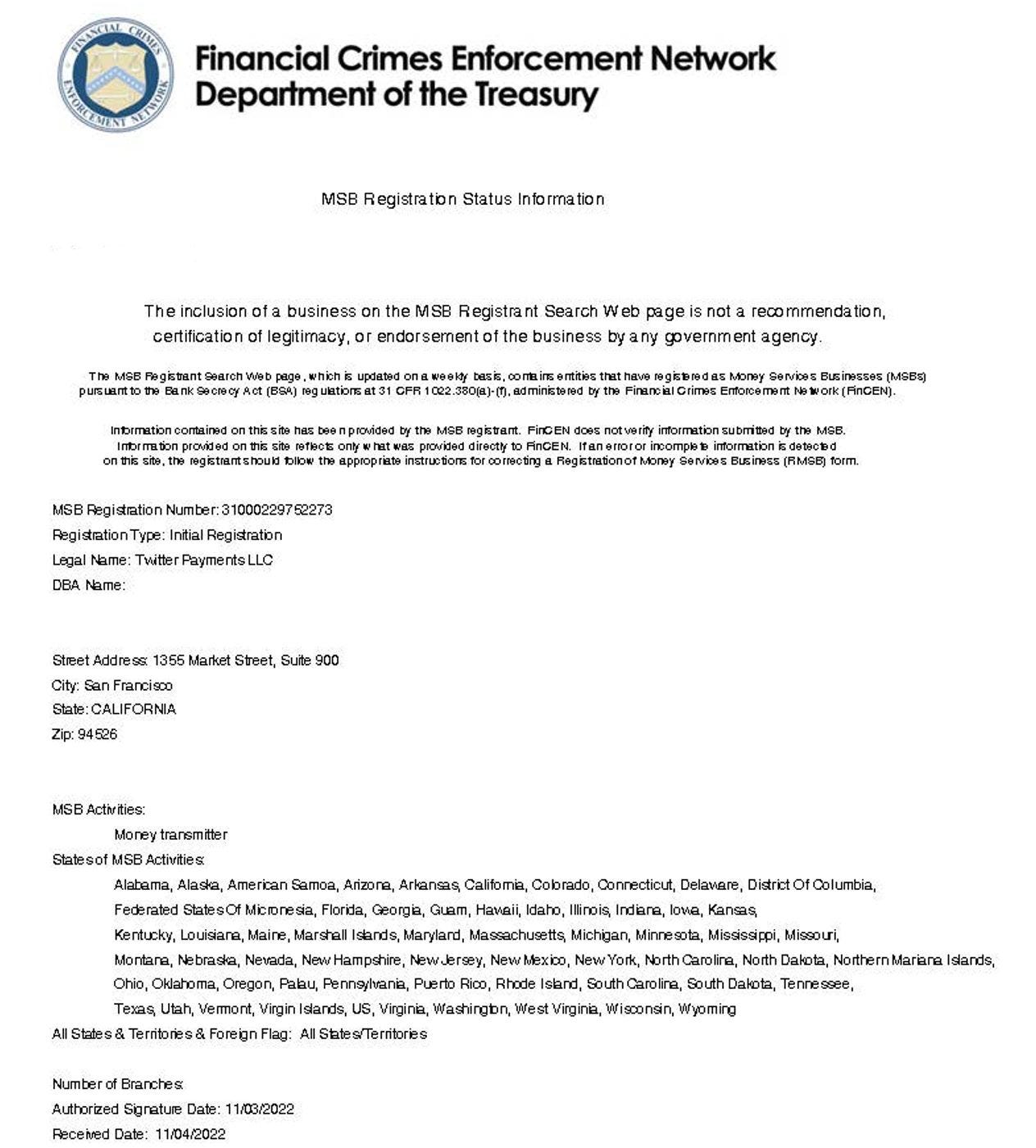

On November 3rd, exactly a week ago, Twitter Payments LLC filed with the Treasury Department's Financial Crimes Enforcement Network (FinCEN) a request to become a Money Transmitter:

The filing above was done by Twitter Payments LLC with a California address. It is a Delaware LLC, which was incorporated on Feb 1, 2022. Let that sink in (and no, I don’t add the same picture again). On February 1, 2022 !!!!!

According to a report by The New York Times of yesterday, Twitter Payments LLC will bring payment processing to the platform. Elon acknowledged the move in a livestream with advertisers yesterday morning, with the Times reporting that Elon "discussed a vision for Twitter to process payments, complete with connected debit cards and bank accounts."

Add that Zoë Schiffer, the Managing Editor of @platformer, who seems to have her ears in Twitter’s walls, tweeted this afternoon, in the middle of all the other Twitter noise

Now Elon may reimburse loans. Or he may do this Payment Platform by himself. Or he may be in a hurry to get it done, and consider …

I’ll let you finish the sentence. For full disclosure, I bought Shift4 stock today.

Have a wonderful evening,

Alexandra

THIS ARTICLE HAS A FOLLOW UP, 48h LATER, READ IT HERE

Have you considered being an investigative journalist!? Intriging. Do you have elon-dar?

Interesting, very interesting…so…playing this out…think Jared could be named the next COO or President or CEO of Twitter? Or maybe Jared wants more time to focus on space?