Yahoo! Finance, help us make a difference

Give your audience a good alternative to credit ratings

Yahoo! Finance

Mr. Andy Serwer, Editor-in-Chief and Mr. Daniel Howley, Tech Editor

770 Broadway

New York, NY 10003

Dear Mr Serwer, dear Mr. Howley,

As a former analyst from 1998 to 2003 with Moody’s Investor Services I am, like you, well aware that rating agencies played a dubious role in the prequel to the Global Financial Crisis in 2008. Banks like Lehman Brothers got undeservedly good ratings. And during the dire times that followed, many people lost their savings, their homes, their jobs.

Fiduciaries, foundations, pension funds, institutional fund managers and retail investors still rely today on these credit ratings provided by the dominant rating agencies. And a significant number of these market participants restrict themselves to only investing in companies that meet some definition of "investment grade".

In Section 939A of the Dodd-Frank Act of 2010 Congress directed federal agencies, including the SEC, ‘to remove any reference to or requirement of reliance on credit ratings’ from SEC rules and to substitute an appropriate standard for credit-worthiness. These discussions are now, twelve years later, still ongoing, as the SEC website illustrates.

Using my expertise as a former rating analyst and the communication platforms of Twitter and Substack, I have brought some of the nefarious practices of rating agencies to a broad audience.

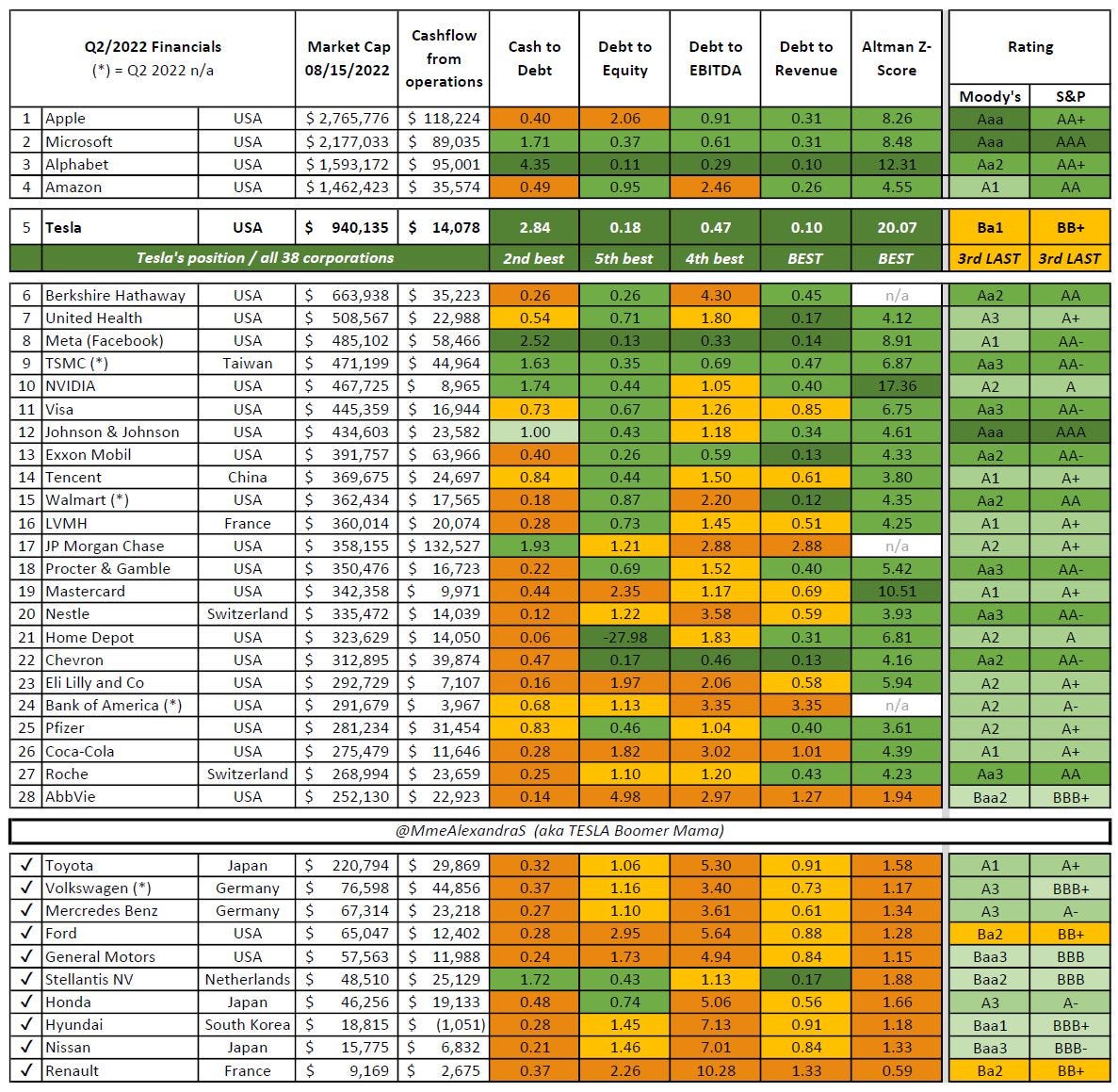

As this table shows using objective quantitative criteria, when we compare the largest mega caps and major players in the automobile industry, several of these companies stand out for having clearly inflated credit ratings whereas Tesla is rated below investment grade.

And yet, Tesla clearly has exceptionally good numbers.

It may be that the rating agencies will take action on Tesla’s rating in due course. But this does not really solve the problem of their lack of objectivity and timeliness in general.

Instead, we need to recognize that the basic nature of their business model is at odds with the interests of real investors and the integrity of the financial marketplace in general.

The business model of the rating agencies has not changed since 2010 and they still skew credit ratings to serve their paymaster corporate clients. This is truly undesirable.

For this reason, we are taking the initiative to address fund managers and fiduciaries to ask them directly to rely less on the credit ratings provided by rating agencies and to look to more objective analyses that are transparent and readily available from company data.

I am working with a very knowledgeable and motivated team and our starting point is the Altman-Z score.

This is a formula for predicting bankruptcy that was first published in 1968 by Edward I. Altman at the time that he was an Assistant Professor of Finance at New York University.

Please refer to the excellent short article on Wikipedia on the calculation and characteristics of this rating, and you will see that you have all base data already available on your own website.

The snapshot Altman-Z score is immediately useful.

But we also want to show the multi-quarter trend of that Altman-Z score.

And there may be other indicators that are suitable for particular industries.

We want to be able to point these fiduciaries and fund managers to a convenient source where the information is readily available.

We are open to sharing our expertise further with your team should you desire for us to do so.

We will look forward to hearing from you on whether you would be interested in carrying these indicators.

Publishing these analyses would be very helpful in our communication with funds and fiduciaries, who would be able to use Yahoo Finance as their go-to website.

We not only want to emphasize to them that it is unwise to use unreliable credit ratings, regardless of whether they be too favorable or too unfavorable, but we also want to give them an easily available source that is actually data-driven and provides a much more reliable indicator.

With kind regards,

Alexandra Merz

I fully agree with Mrs Merz. Many pension plans and thus employees are losing out on their funds returns because of the credit ratings inconsistencies. I rely greatly on Yahoo web site for my own analysis of stocks and the market. The Altman-Z would be a very useful addition.

I completely agree with what has been stated throughout this article, I really hope this information can be spreaded so more people become aware of the big discrepancies between the work the agencies do and publish and the reality of the inappropriate ratings many companies currently have. I specially like the mention of what ocurred in the financial crisis where these agencies failed to downgrade some firms that were clearly headed to bankruptcy.