Thank you all for your attention and feedback on my previous article on Tesla considering share buybacks. I am always amazed about the high level of intellect, knowledge and motivation in our Twitter Tesla family, with so many contributing to the common cause.

Two subjects are important to address here again.

1. An alternative approach to Share Buybacks

@HolgerDanske9 and @CPAinNYC (give them both an immediate follow, please) have done excellent research about an alternative buyback strategy that differs slightly from the buyback stock & retire that has been broadly discussed over the past few weeks.

By using a technique called Treasury Stock Buyback, you obtain all the advantages of a regular share buyback, and more. A treasury stock is defined as a previously outstanding stock that is bought back by the issuing company. By doing so, it puts the repurchased shares back under its own control and reduces the supply of shares available in the market. So far, no difference. Now, instead of retiring (or canceling) these repurchased stock, the company can decide to keep them as treasury shares.

So the repurchased shares are no longer included in the calculation of earnings per share (EPS). Treasury stocks are held by the company for the time being, with the optionality to be retired or re-issued at a later date and ultimately return to being traded in the open markets by:

Capital Raising – i.e. Secondary Offerings, New Financing Round, Acquisitions with a share component as payment

Dividends to Equity Shareholders

Shares Issued Per Options Agreements (and Related Securities – e.g. Convertible Debt)

Stock-Based Compensation for Employees

This table by @HolgerDanske9 and @CPAinNYC sums it up very well:

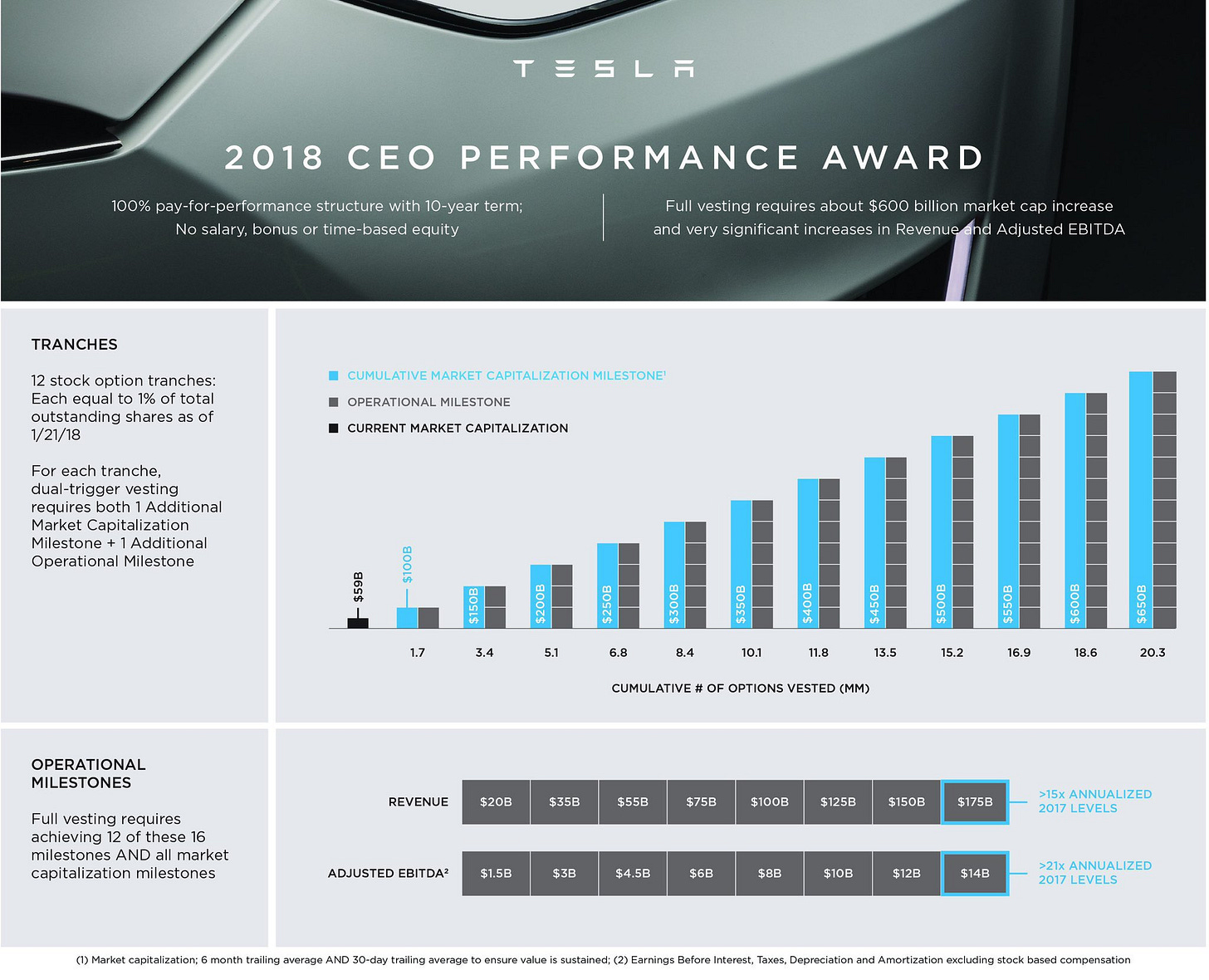

Elon’s CEO Performance Award

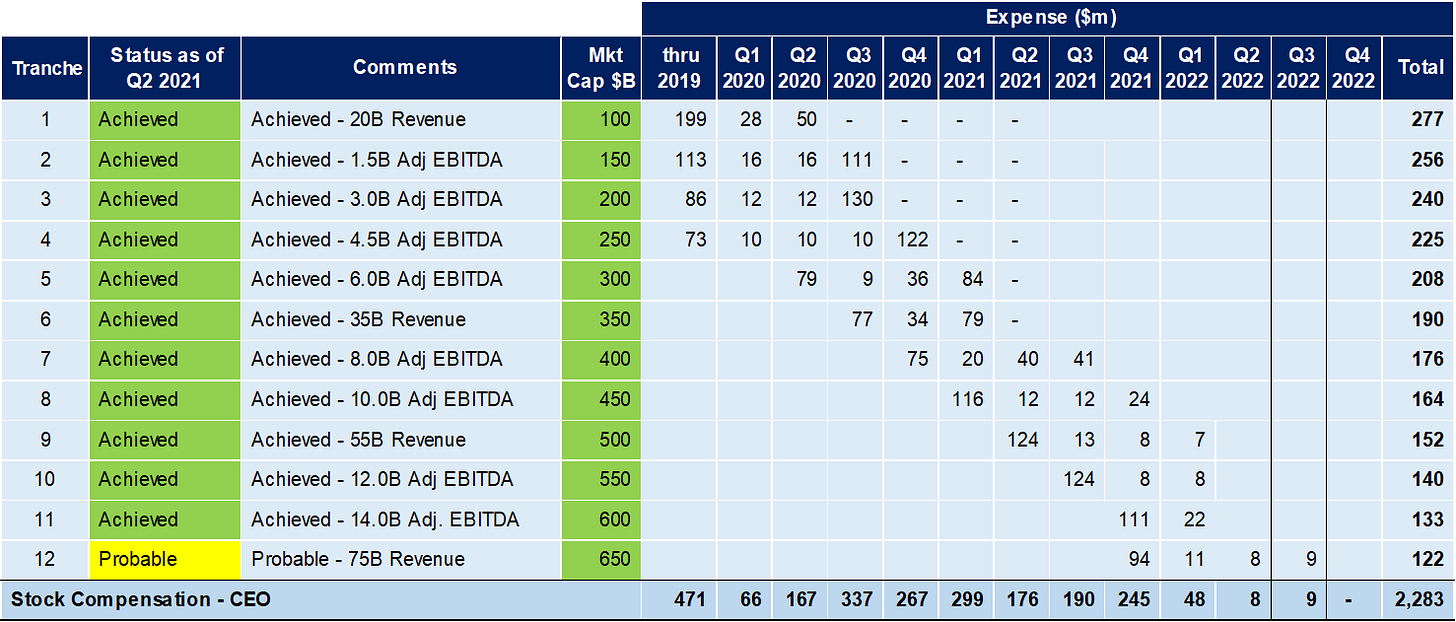

Elon’s 2018 CEO Performance Award has hit all eight EBITDA milestones and the first three Revenue milestones. 11 of the 12 tranches have vested and the final tranche (triggered when Tesla exceeds $75B revenue) is likely to be achieved in Q3 or Q4 this year.

@CPAinNYC clearly laid it out in this table:

With Elon's 2018 CEO Performance Award nearing its end - will we hear details about a new compensation award for him or other high-level executives in the near future? And then there is of course Masterplan Part Trois …

We are continuing to follow the breadcrumbs. And every day to be more passionate about the greatest company in the world (universe?).

Keep on sending me comments, ideas and suggestions.

Very grateful, Alexandra

Alexandra won the Tesla Stock Buy Back youtube discussion with Warren Redlich hands down. I vote for a stock buy back to boost the confidence of all TSLA loyal shareholders.

If there is to be buy back this seems like a good option