Proof that Tesla is already Aaa, by Moody's

And yes, they should be irrelevant! Let's help to make it happen.

Let’s get straight to the point: Yes, Moody’s finally upgraded Tesla Inc. to investment grade (Baa3, stable outlook), but only because the heat was on. I explain it in detail in Episode 33 of The Cyberbulls, you can jump right to it here.

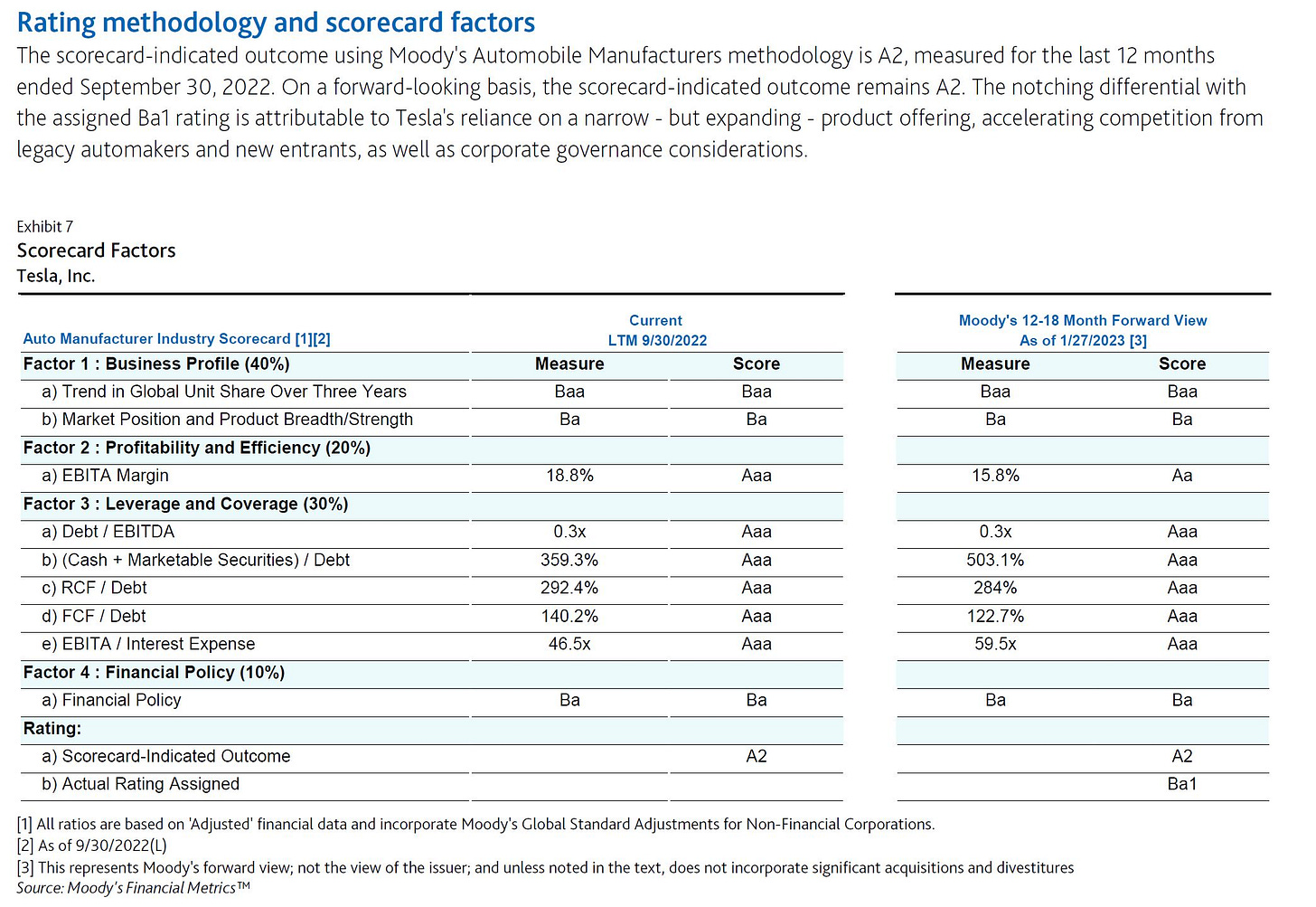

Below is the most ridiculous part of the January 2023 Credit Opinion by Moody’s, which has yesterday been upgraded from Ba1 to Baa3.

This scorecard serves to calculate the rating and is based on the rating methodology for automobile manufacturers, which can be downloaded here. In both the backwards looking table (on the left) and the forward looking table (on the right), Tesla is already “A2”.

But then the overall score can be manually overwritten if the rating agency finds reasons to do so. You bet they did. See in the title above the chart: “Tesla’s reliance on a narrow - but expanding - product offering, accelerating competition from legacy automakers and new entrants, as well as corporate governance considerations”.

Let that sink in: the objective financial factors, Factor 2 and Factor 3, are already Aaa-level for all criteria for the “Last Twelve Months prior to 9/30/2022”.

So what are Factor 1 and Factor 4, for which the scoring model has lower results?

Factor 1 - Business Profile:

Trend in Global Unit Share over three years (10%)

A graph says more than a thousand words, and deserves fully a Aaa-rating in this category. Yet, Moody’s attributed to this factor a Baa-rating, in the sole goal to lower the overall calculation.

Market Position and Product Breath / Strength (30%)

Here Moody’s attributes a Ba-rating to Tesla. The definition for this rating level from the rating methodology isDefensible competitive position focused on one of the four key global geographic regions; gaps/areas of weakness in the product portfolio exist with evidence of material variations in the rate of model renewal; earnings rely on specific products or segments or returns on key products cause periodic pressure. Emissions-reducing technologies and AFV product development may be somewhat lagging, but company has articulated a strategy and concrete plans to attain an industry-average market position in terms of customer acceptance; or investments to meet future regulatory standards are uneven, but company has reasonable leeway before delays will have a meaningful impact on ability to meet future regulatory standards.

This argument has been contradicted by the update release yesterday, where Moody’s states “Tesla will maintain its position as one of the leading manufacturers of battery electric vehicles, as the company further solidifies its global footprint. … Considerable investments in new vehicle and battery cell production facilities enable a steep increase in vehicle delivers. Tesla’s product offering is expanding, with early production of the Cybertruck slated for later this year. The development of a next generation vehicle at targeted 50% reduction in cost holds the prospect for a meaningful decrease in the reliance on the earning contributions of Model 3 and Model Y.

So, Moody’s, no doubt, this criteria Tesla deserves a Aa-rating already. (for definition of a Aa-rating in this category, please refer to the Methodology here)

Factor 4 - Financial Policy (10%)

For this factor, Moody’s attributed a Ba-rating to Tesla. The definition of a Ba-rating is

Expected to have financial policies (including risk and liquidity management) that tend to favor shareholders over creditors; above-average financial risk resulting from shareholder distributions, acquisitions, or other significant capital structure changes.

Moody’s notes in its report that Tesla continues to operate with low financial leverage, has very good liquidity with $22bn of cash and investments, and prospects for very considerable free cash flow.

The only two challenges mentioned in this factor are “considerable latitude exercised by CEO Elon Musk with notable key-man risk” and that Kimbal “has close ties with the CEO”.

To sum it up: In all objective measures, Moody’s understands very well that Tesla is already, by far, Aaa. In more subjective criteria, Moody’s disregard for Elon Musk shines through and the rating agency uses arbitrary means to knock the rating down.

At least we have the rating now in the investment grade zone. Climbing up the ladder will have to follow. The most important is that Tesla investors know the truth.

Moody’s rating change creates in me a feeling of ambivalence. It benefits TSLA shareholders by freeing some institutional investors to buy shares. However, it is an irritating “left-handed compliment” to promote TSLA from junk to junk-plus when, as you point out, the company’s debt, if it were to issue any, should already be considered as safe or safer than other SPX corporations. Oh well. Thank you for detailing the truth in a way that Moody’s should find embarrassing.

Great breakdown. I do agree more with Moody's about the narrow product line and the 'slow pace of new products'. From a simple perspective this is a legitimate argument. As a deeply informed Tesla it is the opposite. Almost all profit comes from Model 3 and Y. 2 models is really narrow

Traditional auto relies on many models and they change the looks on a regular basis, mainly to disquise that there is really nothing substantial new and to offer each type of customer what they want. Some like buttons, some don't. Tesla only has minimalistic/modern. Some like buttons and a more traditional look. The exterior look hardly changes and that is also a real down side in many ways. People just want to be seen, with the latest product, not a look from 2017.

In reality Tesla displays the fastest rate of innovation ever, mainly from the inside! On the long run, this pays out, big time. However, people just want to see new stuff also from the exterior, the looks, the feel etc. As an example why does software change so much, so often in smart phones, while essentially it is not much new really. Once again: allthough huge Tesla bull and about 99% invested in $TSLA. Moody's still has good arguments here. $TSLA could easily improve on this without adding complexity to much by offering some alternative looks.

Also imho, the delay of the Cybertruck has hurt Tesla as a company and the stock significantly. So product line is widening on the near term, but you can not blame a conservatieve agency like Moody's that maybe the exceptionally strange looking Cybertruck might not materialize. Even my wife thinks this is the most ugly car ever. Personally, I am convinced this will be a game changer for $TSLA and most importantly will expand TAM and also widen product line from 2 to 3 models!

Same goes for Megapcks which are not mentioned at all. From Moody's point of view understandable. As a $TSLA investor, I expect this to be income stream number 4 (or even 3) withina few years. Again larger TAM but also important broadening product line. And the Megapack is really very broad as it is outside car market. Elon has more than once said that energy will be about as big as Vehicles. I agree on that, but currently not substantial and not relevant for credit rating. Looking 2-3 years out, It will contribute significantly solving to this Moody's point: narrow product line.

As an investor, I am excited about this development in the near future (2-3 years) as well, because it will contribute to the credit ratings, but also reduce risks for more traditional investors and large institional funds.

The next gen vehicle will be awesome. If $TSLA can pull of anything close to this 50% cost reduction for a compact vehicle, this will chanhe everything. Obviously TAM and product line will be hugely improved. But come on: let that sink in. Lets say at least 30% is cost reduction, regardless of size of the car, then it would imply that Tesla can easily achieve huge gross margins on their products while at the same price point, competition is only trying to achieve minimalistic margins. That really ends most of the competition. It seems it would be coming soon from Mexico, but I think they intentionally do not disclose this.

All together: excited to be a $TSLA investor