Contact your pension funds and fiduciaries now

Enough of limiting the potential of your investment

Please find below a draft letter for you to use, when contacting your pension fund managers and fiduciaries, to enquire about their practices in choosing investments for your money. You can download the text easily here.

Dear [name of fiduciary],

I came across the information below which seems to be pertinent to my investments. I would like to be informed whether you and your firm still uses credit ratings when considering my investments.

In Section 939A of the Dodd-Frank Act of 2010, Congress directed federal agencies, including the SEC, ‘to remove any reference to or requirement of reliance on credit ratings’ from SEC rules and to substitute an appropriate standard for credit-worthiness. These discussions are now, twelve years later, still ongoing, as the SEC website illustrates.

This is unacceptable, but more importantly may have adverse consequences for my investments. While rating agencies played a dubious role during the housing crisis in 2007, too many fiduciaries, foundations, pension funds, institutional fund managers and retail investors still rely today on these credit ratings provided by the two dominant rating agencies.

These rating agencies don’t work for the common good. They have a business model where they serve their paying clients and this business model still makes it too attractive to skew the ratings. As a result, financially weak companies may be labeled investment grade (jeopardizing my money if you invest in them) while other companies that are financially strong but not clients of the rating agencies may not get investment grade (depriving me of potentially good returns).

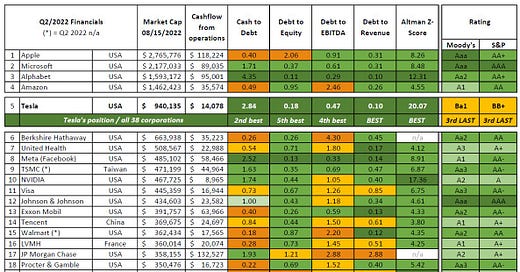

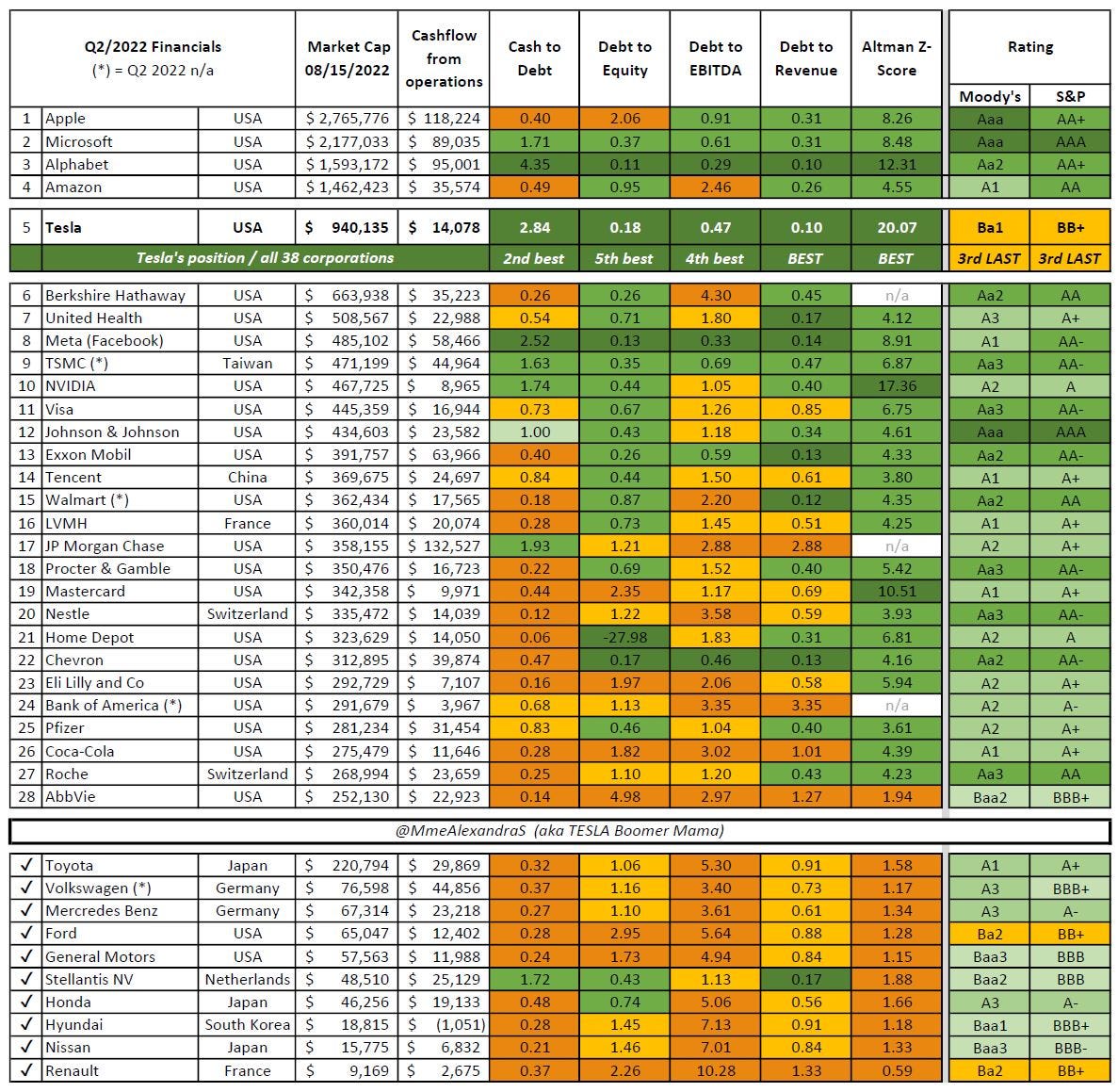

That improper ratings still are common is shown by an investigation of car companies. Tesla, a car company that is financially very strong according to several financial benchmarks is rated junk, whereas financially much weaker companies are deemed investment grade. See this table, which was compiled by a former Moody’s analyst.

Now, for Tesla, pressure has been exerted on the rating agencies and they are likely to finally upgrade the company in the coming months. It does however remain to be seen whether the financially weak companies get a downgrade.

In view of this, of all people, a fiduciary can’t knowingly rely on skewed data. To me it looks like the Altman-Z score should be taken into account as an alternative or additional criterion when making investment decisions.

While not being an expert on this, yet given the relevance for my investments, I’m curious what thoughts and investment procedures you have developed on this long standing issue. How can one be a fiduciary if one knowingly relies on skewed data from organizations with their own agenda?

Very much looking forward to hearing from you,

Yours sincerely,

xxx

You've won! Well done, and thank you!

Thank you very much for all that you do @TeslaBoomerMama. Sincerely appreciate.

@jvbimages22. Janet Bible